Journal Entry Template (JET) - Correction Reminders

60 Day Rule for Corrections

Please remember that correction journal entries are to be uploaded within 60 days of the original transaction date. Correction journals require an original GL Transaction date for GL entries or Grants Expenditure Item Date for Grants entries as well as a 60 Day Correction Reason, if the original transaction’s effective date for GL entries or Expenditure Item Date for Grants entries is more than 60 days prior to the correction. Special circumstances for late entries must be documented in the 60 Day Correction Reason field in JET. The journal entry will be reversed if it is late and the circumstances are not appropriate for a late entry.

Everyone should be reviewing their accounts on a regular basis to identify corrections in a timely manner.

Valid and Invalid Reasons for Late Corrections

We’ve been asked by customers to provide some examples of valid and invalid reasons for making a correcting journal entry. Please see below for the most common examples:

Examples of valid reasons for late corrections are: Correction requested by Finance via Footprints ticket #XXXXXX; Moving transaction to correct object code per Finance; Correcting function code.

Examples of invalid reasons are: Just found out that wrong account string was used; Didn’t have access to JET; Didn’t use correct activity code (unless directed by Finance); Charged wrong organization.

Additional Information for Correction Entries

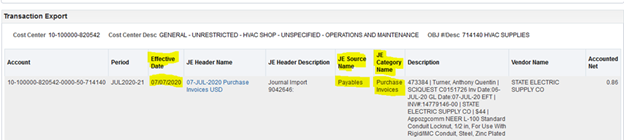

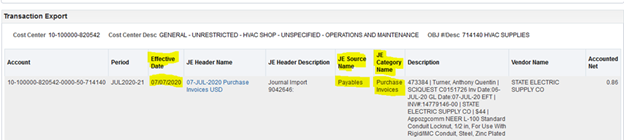

To process a correction entry, you will need to know the Journal Category and effective date of the original transaction. For GL entries, you can find this information in the Transaction Export tab of the OBI Finance dashboard. You can search for a transaction using segments, descriptions, or vendors. For more information on GL Transaction Export in OBI, see the Transaction Export reference guide.

The transaction below is an AP transaction with an original GL effective date of 7/7/20. You would use the category Corrections-AP and the original GL transaction date of 7/7/20 when processing a correction for this transaction. Since the correction would be within 60 days of the original transaction, no correction reason is needed. PLEASE TAKE CARE TO ENTER THE CORRECT ORIGINAL TRANSACTION DATE IN THE GL ORIGINAL TRANSACTION DATE FIELD IN YOUR ENTRY. Finance is auditing the accuracy of these dates.

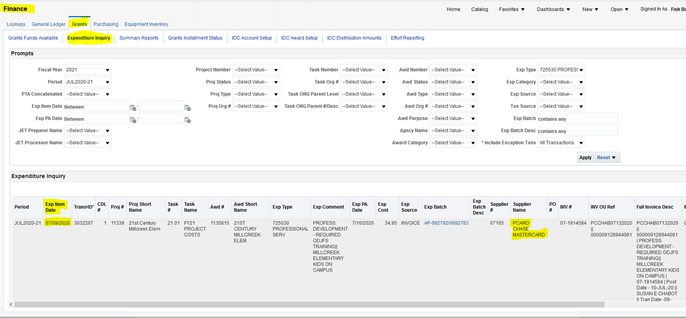

To see detail for individual Grants transactions, use the Expenditure Inquiry option on the Grants tab of the Finance dashboard. You can search for transactions using Project, Task, Award or Expenditure information (and several other categories). For the transaction shown below, the original Expenditure Item is 7/9/2020 and the category for a correction JE would be Corrections – Pcard/Concur. For more information on Grants Expenditure Inquiry, see the Expenditure Inquiry reference guide.

For more information on JET, Correction Entries or navigating OBI, please visit the JET webpage and the OBI Training webpage.

Questions? Contact financecustomercare@ohio.edu.